“A general stabilization of trends and a gradual recovery for logistics real estate market”, it’s revealed by the 21st edition of Borsino Immobiliare della Logistica – first semester 2016, realized by Research Department of World Capital. “The first six months of 2016 result unchanged compare to previous semester, with the exception of a slight increase of rents for recent properties.”

This is the scenery shown by the new edition of Borsino, which in its first part it pays attention to national logistics real estate market, concerning first six months of 2016, with focus on Italian and European prime locations. Main theme, Logistics for eCommerce, sector which contributes to growth of global and our Country’s economy.

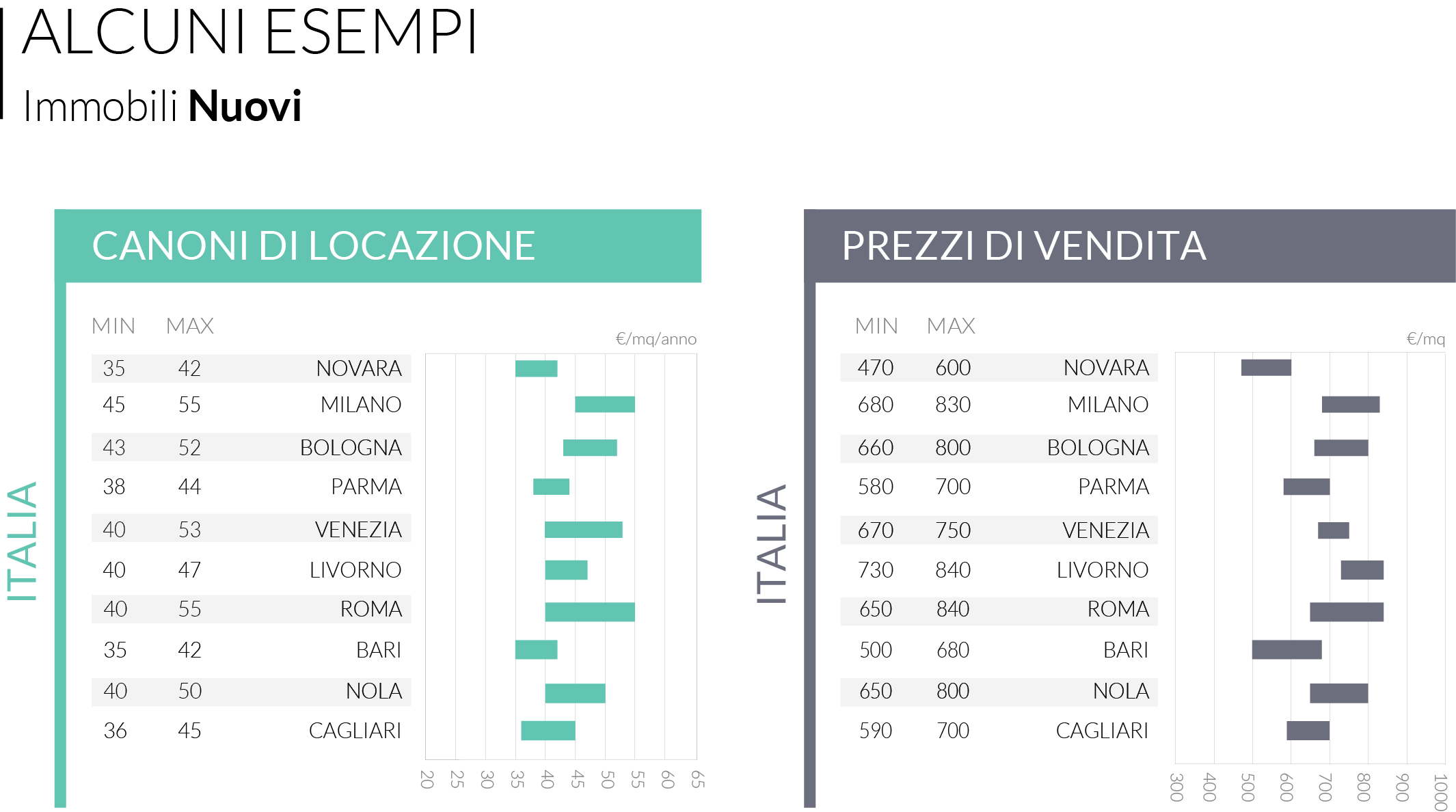

“Among Italian prime logistics location, – claims Neda Aghabegloo, Research Responsible of World Capital – those of North highlight some slight positive variations for rents of recent properties, this is caused by a demand, which is more and more detailed and customizable. We reach a maximum of 3% in cities such as Bergamo and Trento. Concerning Centre and South the variation measured swings between 3% and 6%, in prime locations such as Florence, Pescara, Lecce, Nola, Caserta, Catania and Palermo. Also concerning recent properties for rent, the cities of Milan and Rome continue to have the highest maximum rent of 55 €/sqm/year.

In these two prime locations, moreover, the demand continues to be mean-high, whereas in cities such as Verona, Rivolta Scrivia and Gioia Tauro the offer is mainly highlighted.

Concerning recent properties for sale, – specifies Neda Aghabegloo – sale prices are also unchanged. Exception for prime cities such as Milan (maximum sale price 830 €/sqm), which passes the baton to Livorno and Rome, which record the highest value with a maximum sale price of 840 €/sqm.

Focusing on values of aged properties for sale and for rent, whereas, – continues Neda Aghabegloo – the highest rent is recorded in prime locations of Milan and Florence (50 €/sqm/year), whereas the highest sale price is in Trento with a maximum value of 750 €/sqm. Concerning aged properties for sale, trend results to be more dynamic, especially in North, in cities such as Milan, Bologna, Bergamo and Piacenza, where range of biannual variation swings between 1% and 4%.

Concerning aged properties for rent, it’s observed a general stabilization of market, with an exception for North, which records biannual positive variations from 2,6% (Venice) to 5,8% (Novara).

Finally, gross yields are interesting, – concludes Neda Aghabegloo – they swing between 7,5% and 9% and they evaluate two important features such as location and quality of product. This factor seems to be one of the causes, for which we also record a strong interest from foreign investors, who are oriented in logistics prime locations.”

Look at Video Presentation