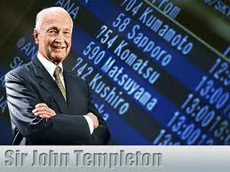

The Dean Global Investment *. Sir John Templeton, one of the wisest and most respected investors in the world, adopted 10 principles which apply to investors. World Capital revisited these rules applied to finance investment income, to maximize and have a proper management of the assets. These are the principles that can help you achieve success and not be overwhelmed by un’intemperia!

1. Invest to earn: the first objective is to maximize the net return. Since always the buildings are the preferred safe haven for their constant re-evaluation, the same will be for you.

2. Keep open mind : diversification and portfolio investment strategies and carefully evaluates the components of return : capital appreciation and income. Stretches beyond the boundaries and be flexible …

3. Don’t follow the crowd: rowing against the current, but be careful to do it yourself ! It takes professionalism, experience and method in real estate. And he dares , Sir Templaton say : “If you’re brave enough to buy when others are willing to sell and sell when others are eager to buy , you’ll get the best reward .”

4. Everything changes: “the markets are not always downhill, or uphill … ” . It ‘ important to rely on professionals, attentive knowledgeable of the market and its dynamics.

5. Avoid fads : choose experts to assess objectively , not subjectively or emotionally , the different investment opportunities. Differentiated …

6. Learn from your mistakes: ” this time is different , the four most expensive words in the history of the markets .” Carefully consider your choice : a mistake could prove fatal !

7. Buy during periods of pessimism: ” the period of maximum pessimism is the best to buy , and the period of maximum optimism is the best time to sell ,” the wise Sir Templeton says. Pessimism , skepticism , optimism and euphoria determine the flow of the market … you act .

8. Hunt for value and business: omits forecasts and trends and research value . Entrusted to those who are able to turn it into business!

9. Search worldwide: broaden your horizons , ranges in the world , the more opportunities you will be proposed and the lower the risk of error .

10. Nobody knows everything: “the investor who has all the answers , maybe not even understand the questions.” Not a professional, but a service company with a team of competent and efficient , this is the qualified counselor .

* Called ” Dean Investment Real Estate ” by U.S.A. magazine Forbes.